The premier tool to verify identity

Fake identification has become increasingly sophisticated, making traditional visual inspections of ID documents insufficient and stressful. Most digital ID verification tools rely on the same core indicators, making them limited and easy to bypass.

Treefort’s Identity Verification Technology (IDV) goes beyond checking if physical ID documents are valid. Utilizing multi-factor identity authentication, Treefort ensures that your client is who they claim to be.

What Makes Treefort IDV Different?

Your new client is not known to the firm

Acting on a mortgage free property

The transaction involves a private lender

There is a quick closing date on transaction

You have identified other key red flags in the transaction

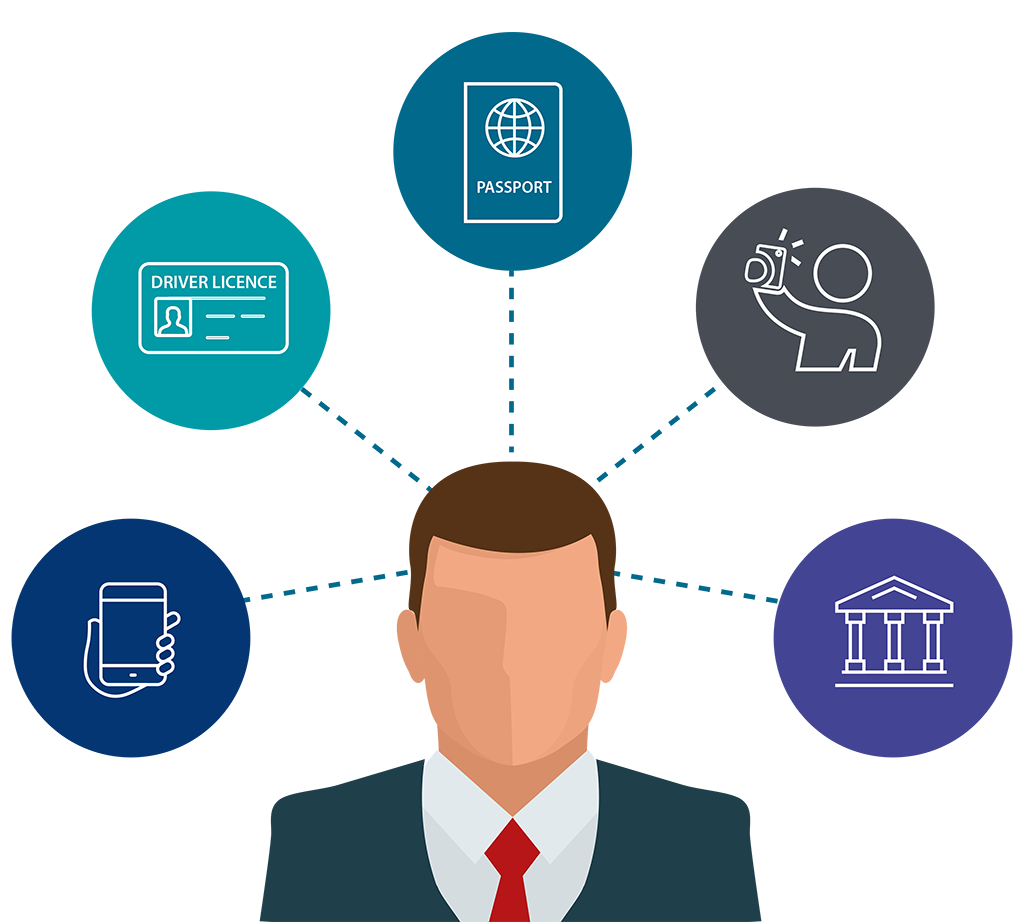

Advanced MFA Technology

Treefort IDV uses a combination of technology and information sources to analyze countless security features found in government-issued ID to authenticate the document and verify identity. This enables you to know that your clients are who they claim to be, whether you're meeting remotely or in-person.

Traditional ID Verification

Treefort Identity Verification

Technology and Information Partners:

Take your fraud mitigation efforts to the next level with Banking Verification, an optional feature to enhance your IDV report. When enabled, this feature will securely and confidentially authenticate the primary bank account, allowing you to make a more informed assessment of your client.

Banking Verification is best used when:

Banking information is securely and confidentially exchanged between your client and their financial institution via Flinks. There are no passwords, account access or balances shared with Treefort or you as the IDV requestor.

Detailed Reports

Treefort’s expansive IDV Reports are designed to document your client’s identification information and provide insight on potential risk indicators of fraud and money laundering activity associated with the individual.

Risks are identified via a rigorous Know Your Client (KYC) assessment made across the three fundamental KYC elements:

Fraud

![]()

Checks for indicators of potential identity theft using a proprietary algorithm and network of reliable source partners.

Compliance

![]()

Satisfies Government ID, Credit File and Dual Source identification methods.

Anti-Money Laundering (AML)

![]()

Identifies potential money laundering risks, including political watch and sanction lists.

There are two convenient ways to order a Treefort IDV:

Treefort Account

Issue and manage IDVs directly from your Treefort account. View archived reports and billing activity, and access additional services.

Register to order

KYC On-Demand

An on-demand service to send IDV requests when needed. No account setup or training required. Available within Stewart's NextSTEPS ordering platform, and online.

Order now

Why Choose Treefort?

Used by thousands of legal, mortgage and real estate professionals across Canada to improve workflow, detecting millions of dollars in attempted title fraud.

SOC 2 compliant, featuring end-to-end encryption and secure data storage for strong security and privacy. IDV Reports are accessed via permission-based access controls.

Treefort’s Customer Support Team is available to assist you and your clients via phone or email. An online Knowledge Base also available for self-help support.

A Simple IDV Process

Reduce Premiums

Thanks to the effectiveness of Treefort’s technology as a title fraud mitigation tool, Stewart is proud to offer a reduced premium for residential and commercial policies when each purchaser or borrower in the transaction completes a Treefort IDV.

Contact us for details.

We’re Invested in You

Stewart Title is committed to working with the Canadian legal community to maintain their reputation as trusted quarterbacks of real estate transactions. Our investment in Treefort is an example of this commitment, as we work together to safeguard real estate transactions from being a target for title fraud and money laundering activity.

Treefort's identity verification tools make it simple for legal practices to confidently move forward with their clients and avoid the stress of potential involvement in title fraud.

Contact Me

Interested in bringing Treefort IDV tools to your office?

Register here, order now with KYC On-Demand or enter your details and a Stewart representative will be in touch.

Trademarks are the property of their respective owners.

.png?sfvrsn=76b172ba_4)